NW 7th Avenue

Community Redevelopment Area (CRA)

The NW 7th Avenue CRA focuses on revitalizing and enhancing the economic and social landscape of Miami-Dade County's historic neighborhoods through strategic investments in infrastructure, business development, and community engagement.

79

Total Grants Awarded

$3 Million

Total Funding Awarded

97

Businesses Served Since Inception

Community Redevelopment Agency (CRA) refers to a public entity established by a city or county to carry out community redevelopment activities as outlined in the Community Redevelopment Act, which was enacted in 1969 (Chapter 163, Part III, Florida Statutes). A Community Redevelopment Area is a type of special district that relies on future increases in property values to fund economic development projects within the district.

CRAs are established to preserve and enhance the tax base by creating clean and safe places, reduce crime, promote economic development, increase housing options, improve infrastructure and streetscape, attract and retain businesses, and enhance parks and recreation.

Under Florida law (Chapter 163, Part III), local governments can designate areas as Community Redevelopment Areas when slum and blight conditions exist. “Blighted area” means an area with a substantial number of deteriorated or deteriorating structures; in which conditions endanger life or property or are leading to economic distress. The statute further defines blight in which two or more of the following factors are present:

Predominance of defective or inadequate street layout, parking facilities, roadways, bridges, or public transportation facilities.

Aggregate assessed values of real property in the area for ad valorem tax purposes have failed to show any appreciable increase over the 5 years prior to the finding of such conditions.

Faulty lot layout in relation to size, adequacy, accessibility, or usefulness.

Unsanitary or unsafe conditions.

Deterioration of site or other improvements.

Inadequate and outdated building density patterns.

Falling lease rates per square foot of office, commercial, or industrial space compared to the remainder of the county or municipality.

Tax or special assessment delinquency exceeding the fair value of the land.

Residential and commercial vacancy rates higher in the area than in the remainder of the county or municipality.

Incidence of crime in the area higher than in the remainder of the county or municipality.

Fire and emergency medical service calls to the area proportionately higher than in the remainder of the county or municipality.

A greater number of violations of the Florida Building Code in the area than the number of violations recorded in the remainder of the county or municipality.

Diversity of ownership or defective or unusual conditions of title which prevent the free alienability of land within the deteriorated or hazardous area.

Governmentally owned property with adverse environmental conditions caused by a public or private entity.

A substantial number or percentage of properties damaged by sinkhole activity which have not been adequately repaired or stabilized.

To document that these required conditions exist, the local government must survey the proposed redevelopment area and prepare a Finding of Necessity, known as a FON. If the FON determines the required conditions exist, the local government may create a Community Redevelopment Area to provide the tools needed to foster and support the redevelopment needs.

Since all the monies used in financing CRA activities are locally generated, CRAs are not overseen by the state. Still, redevelopment plans must be consistent with comprehensive plans from the local government.

Tax increment financing, or TIF, is a unique tool for redevelopment activities for cities and counties. It leverages public funds to promote private-sector activity in the targeted area. The dollar value of all real property in the CRA is determined as of a fixed date. Taxing authorities, which contribute to the tax increment, continue to receive property tax revenues based on the base value. These base revenues are available for general government purposes. However, any tax revenues from increases in real property value, referred to as “increment,” are deposited into the CRA’s Trust Fund and solely dedicated to the redevelopment area.

It is important to note that the tax increment financing process does not affect property tax revenue collected by the School Board and any other special districts. Any funds received from a tax increment financing area must be used for specific redevelopment purposes within the boundaries of the CRA and not for general government purposes.

The CRA administers these activities and programs within a Community Redevelopment Area (Area). The CRA “Board,” created by the local government (city or county), directs the Agency. CRA Boards do not establish policies for the city or county; they establish CRA Board policies, develop, administer, and implement the CRA’s Plan. The CRA operates independently from the Board of County Commissioners (BCC). The CRA has certain powers that the city or county may not have, such as establishing tax increment financing (TIF) and leveraging local public funds with private dollars to make redevelopment happen. There are currently over 220 Community Redevelopment Areas in the State of Florida. To obtain a current list, please visit the Florida DEO website.

Learn More About CRAs

New & Noteworthy

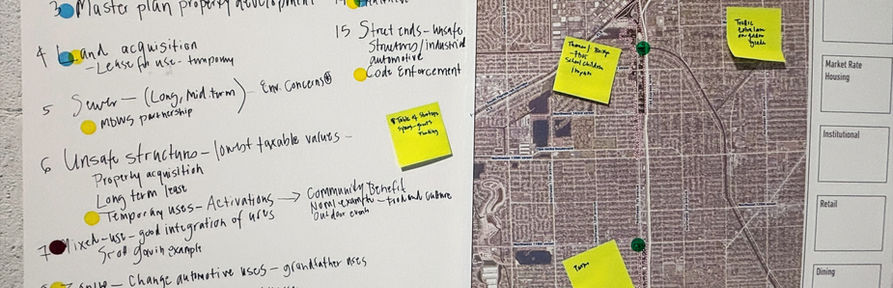

Timeline of the NW 7th Avenue CRA

95 LLC, decided to discontinue negotiations.